michigan property tax rates by township

32 rows Multiply the taxable value by the millage rate and divide by 1000. Property is forfeited to county treasurer.

Prorating Real Estate Taxes In Michigan

For payments made after 430 pm Sept.

. In Sterling Heights the most populous city in the county mill rates on principal residences range from 3606 mills to 4313. 1 day agoBy Fox 2 Staff. 84 rows Michigan.

Whether you are already a resident or just considering moving to Bangor Township to live or invest in real estate estimate local property. Rates also include special. The Millage Rate database and Property Tax Estimator allows individual and business taxpayers to estimate their current property taxes as well as compare their property taxes and millage.

Rates include special assessments levied on a millage basis and levied in all of a township city or village. Lansing MI 48917 Assessing Home. Delta Township MI Assessing Ted Droste MMAO AssessingBuilding Director Contact Email Assessing Township Hall 7710 West Saginaw Hwy.

There is a 395 charge. The average effective property tax rate in Macomb County is 168. Information regarding personal property tax including forms exemptions and information for taxpayers and assessors regarding the Essential Services Assessment.

174 of home value Yearly median tax in Macomb County The median property tax in Macomb County. FOX 2 - Shelby Township Police announced the death of one of their officers late. State Summary Tax Assessors Michigan has 83 counties with median property taxes ranging from a high of 391300 in Washtenaw County to a low of 73900 in Luce County.

County Treasurer adds a 235 fee. For example if a property is a principal residence with a taxable value of 50000 and is located in Humboldt. Published November 5 2022 1108PM.

This can be obtained from your assessment notice or by accessing your tax and assessing records on our. Summer Tax Bills - Property taxes may be paid online or at Township Hall beginning. Box 87010 Canton MI 48187 Online Tax Payment We accept cash personal checks bank checks MasterCard Discover and Visa.

Median property tax is 214500 This interactive table ranks Michigans. Macomb County Michigan Property Tax Go To Different County 273900 Avg. For existing homeowners please enter the current taxable value of your property.

Rates include the 1 property tax administration fee. 430 pm on Sept. The Pittsfield Township 2019 Total Tax Rate of 64381 breaks down in the following way.

Learn all about Bangor Township real estate tax. Interest increases from 1 per month to 15 per month back to 1st prior year. Canton Township Treasurer PO.

Taxes Tax Comparison Ordered by Millage Rate.

Property Taxes By County Interactive Map Tax Foundation

Statewide Average Property Tax Millage Rates In Michigan 1990 2008 Download Table

Michigan S Property Tax Rate Among Highest In Nation Across Michigan Mi Patch

.png)

Where Property Taxes Are Allocated Washington Township

State Individual Income Tax Rates And Brackets Tax Foundation

Detroit Property Tax Assessments To Decline As 62 000 Properties Face Foreclosure Mlive Com

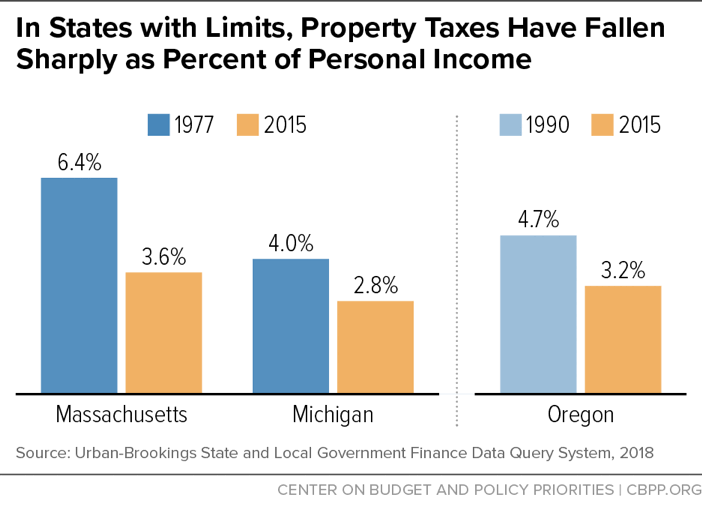

State Limits On Property Taxes Hamstring Local Services And Should Be Relaxed Or Repealed Center On Budget And Policy Priorities

2020 Michigan County Allocated Tax Rates Center For Local Government Finance Policy

1969 City Of Detroit Michigan Property Tax Rates Fold Out Information Mailer Ebay

Resources Property Tax Consultants

Compare 2021 Millage Rates In Michigan Plus Fast Facts On Property Tax Trends Mlive Com

Upstate Ny Has Some Of The Highest Property Tax Rates In The Nation

Property Tax Calculator Estimator For Real Estate And Homes

Why Property Taxes Go Up After Buying A Home In Michigan

Tangible Personal Property State Tangible Personal Property Taxes

100 Michigan Cities And Townships With The Highest Property Tax Base Mlive Com

States Moving Away From Taxes On Tangible Personal Property Tax Foundation

Michigan Property Tax Calculator And Property Tax Appeal Information